One of the questions I am asked most frequently is, “Where can I invest in precious metals to maximize returns?” The answer is not as straightforward as one might expect.

An area that comes to mind for many is the futures market, where the leverage is great and the rewards can be just as great. However, to be successful requires much more time, effort, and money than many a novice “futures trader” can handle. The amount of success in trading the futures is a very low percentage, something on the order of 2%–3%. It has been my experience having done both futures and stock trading that stock trading/investing is much better suited to most private investors and allows leverage that is similar to and sometimes exceeds that of the futures market.

The advantages are that your risk is better controlled most of the time. I want to be clear: both futures trading and stock investing/trading are risky endeavors, but investing as a whole has risk, as does life itself. The point is, given the risk/reward profiles of futures or stocks, my experience is that stocks are more appealing.

This is a time period when gold and silver have been moving in a large trading range and the underlying mining equities have been reacting in a sluggish manner. That is to state, the mining shares generally have not performed in a manner providing greater leverage than the metals themselves.

There is still plenty of time for an investment in precious metals, but a wise investor should choose carefully ahead of the herd. It is my considered opinion that the window of opportunity exists right now for those who are not in this market or for those who wish to have further exposure to the precious metals. This window of opportunity may not last to the end of this year. In fact, let me go on record and state that the next two to four months should provide one of the best and safest times to purchase quality mining companies. If you can purchase during general stock market weakness and when metals prices are down as well, you can be pretty well assured you are buying low, before the next leg up in this market.

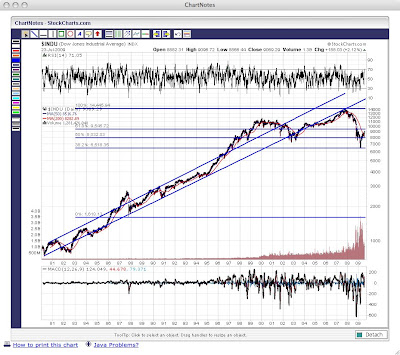

The big money is made if you catch a major trend and stick with it long enough to make substantial gains. Our premise is that the era of paper assets peaked in the year 2000, and commodities were at the bottom. We also believed that the paper money time bomb was ticking and astute investors around the world would seek the safety and time-tested soundness of real money—gold and silver. These two precious metals represent the top tier of all commodities, because they are readily accepted around the world as a means of final payment. Additionally, in times of financial stress, the metals are a store of value.

Basically, you have been given a second chance to buy before the next major leg up in the precious metals cycle and it is my firm belief that this time it will be led by the mining equities, for a number of reasons. First, there are more equity investors in the

Most people are lazy to some degree and they will do whatever is easy and convenient, and that means, as stated above, when the precious metals bull begins to run again, people are far more apt to purchase mining stocks than to buy silver or gold coins.

Silver Stocks

At this point in the precious metals cycle, many investors who discover the silver market may think they have missed most of the move. In fact in some cases they are correct. Our financial reports focus on “Money, Metals, and Mining,” and quite frankly, I cannot give you the opportunities we saw and recommended in 2002-2006 . . . but the next leg up will be very worthwhile, especially in light of the fact that the investing public trusts almost nothing in terms of “investment” at this time.

Real estate investing is dead, stocks have rallied but for how long, the municipal bond market looks shaky, and even the sacred U.S. Bond has been shunned to a great extent by foreign trading partners.

The most important fact about investing in the precious metals, actually for almost all markets, is simply that the majority of the move comes in a very compressed timeframe. One way to think about it is that maybe 90 percent of the entire move comes in the last ten percent of the time. If this cycle for silver is going to last 15 years, then the majority of the move upward will come during the last year. I call this the “blow-off” phase, or the “greed-panic” phase. In my view, this will occur because everyone will be dumping the U.S. dollar for something/anything, and the most sought-after class is the precious metals.

Notice I did not state gold, but precious metals. Certainly gold will be sought, but silver and silver-related investments would be the star performer at the end of the cycle. There are two reasons for this. First, silver is more affordable than gold. Those investors flooding into this market during the panic phase will be looking for the best alternative to the U.S. dollar possible, and that will be silver because it costs less per ounce than gold. Secondly, most will do some cursory investigation and find that silver outperforms gold during inflationary times.

To validate my point, think back to the dot-com bubble. Every little company with an Internet address was moving up, and most had very little merit. This is typical of markets-- near the end the public rushes in and drives prices to unsustainable levels.

First it must be understood that the universe of true silver stocks is extremely small. My definition of a true silver stock is a company whose primary revenue stream is based on silver. This is an unusual creature because approximately 75 percent of all silver comes from the mining of other metals. Depending upon which study you examine, about 25 percent of silver mined is a result of copper mining, 33 percent is a result of lead/zinc mining, and even 14 percent of silver comes out of the ground as a result of gold mining.

The reason an investor wants a primary silver producer is the fact that the stock price will be leveraged to the price of silver. If an investor buys a stock that has its primary metal as copper yet still yields quite a bit of silver, the company is more apt to move on the price of copper not silver.

Additionally, most miners who are base-metal miners and have a great deal of silver in the mix really do not care about the silver price, and they sell it for "peanuts" to use the proceeds against their primary mining activity. You may find other information on a huge universe of silver stocks available, but take your time to study and educate yourself. Just because a company has silver in its name, or is exploring to find silver, that does not make it a silver company.

It is an honor to be.

Sincerely,

David Morgan

Mr. Morgan has followed the silver market for more than 30 years. He wrote the book, Get the Skinny on Silver Investing. Much of his Web site, Silver-Investor.com, is devoted to education about the precious metals; it is both a free site and does have a members-only section. To receive full access to The Morgan Report, click the hyperlink.